Response to "Safelite is a PBM"

Matt Stoller wrote up Safelite's similarities to the PBM industry. This July I had wonderfully bad luck and had two separate windshield-rock incidents.

Today, Matt Stoller wrote up Safelite and how similar it is to pharmacy benefit managers. This kind of thing really calls to me — comparing pharmacy to other industries, AND due to a bit of bad luck, I have very relevant recent experience.

In July, I drove to St. Louis, and I had a bit of bad luck in the form of a rock hitting my windshield and causing a big ole crack across the driver’s side of the front windshield. When I arrived in St. Louis, I drove to the nearest Safelite, and tried to schedule an appointment. The scheduling staff told me that unfortunately, their computers were down due to the CrowdStrike hack. Specifically, they could start the process of scheduling an appointment, but the system would fail out at the same step of the process every time. I assume that there was some kind of central Safelite server ping to confirm the appointment, and that server was running CrowdStrike’s endpoint management service. Anyway, this broke me out of “go to the big place with the national ad budget and brand recognition” mode, so I did a little web searching and found out that literally across the street there was a competing auto body and glass repair shop, so I asked them for a quote. When the price came up at $752.24, I decided to get competing quotes from other places around town, and discovered that I had wandered into the least expensive glass shop in south St. Louis County, SOS Auto Glass and Calibration. They had to order in the specific glass for my car, but they drove out to the place where I was staying the next day and replaced the glass in the driveway. 10/10 would recommend.

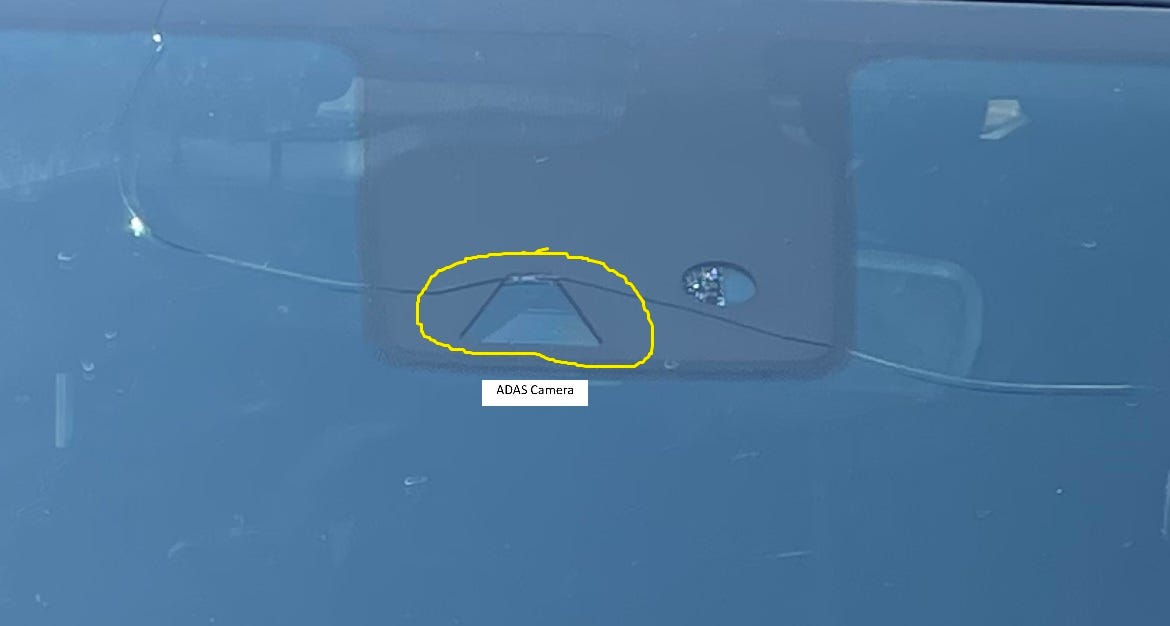

Sidebar here for the fortunate people who have not had to replace glass on a newer car: every time you replace glass on newer cars with “Advanced Driver Assistance Systems” (ADAS - basically a fancy camera up against the top middle of the front windshield along with what I call “dalek bumps” on the bumpers), you have to have the ADAS system recalibrated. This substantially increases the cost of a glass replacement. The process basically consists of putting the glass on and then holding up what amounts to a giant QR code in front of the camera for the ADAS to test its focus against. I did not even realize that my car HAD a front facing camera (and rain sensor!) before I learned that my car needed FANCY glass replacement.

Anyway, in the process of getting a thousand quotes for glass replacement, I called my insurance carrier, which routed me through their IVR to press a series of buttons that connected me eventually to “Safelite Solutions” who actually handled my glass claim. The experience was very reminiscent of calling the phone number on a health insurance card branded “Blue Cross” and getting routed to “CVS/Caremark” when you press the button for pharmacy benefits. The big national brand that you know from radio ads and facebook ads is also the insurance carrier’s administrator for a specific type of peril.

Turns out my comprehensive car insurance policy has a $1000 deductible, but has a separate $50 glass deductible. This also reminds me of the same health insurance/pharmacy benefits divide - a fair number of insurance policies will have separate pharmacy/health insurance deductibles. Take Medicare Part B and Medicare Part D for example: in 2024, Part B has a $240 deductible. A Defined Standard Part D Plan has a separate $545 deductible.

However, as I would come to learn a week later, the term “deductible” in Auto/Casualty benefits is really more equivalent to the term “copay” in Health/Pharmacy benefits. No wonder the general public doesn’t understand pharmacy deductibles! The word “deductible” doesn’t even mean the same thing across different lines of insurance. Cost sharing is dumb and confusing.

So there I am, pleased as punch with my new windshield from SOS Auto Glass, and a few days later I drive back home from St. Louis. While driving, ANOTHER rock hits my new windshield and cracks it. At this point, I’m curious how much of a price difference to my insurance carrier there was between SOS and Safelite - would the big boy be cheaper or more expensive? So after arriving home, I take my car to Safelite here in Salt Lake City. They schedule me for two days later, in person at their shop. Turns out that they charge $881.87 for the same glass+calibration service. That’s $129.63 more than SOS Auto Glass. To me, the end consumer, after my insurance kicked in, the price was the same each time: my $50 “deductible”. I did not try to get a price quote without involving my insurance this time around, in part I think because Safelite already knew that I was covered from looking up the VIN of the car.

Even more recently, I noticed that a car I was borrowing had like 6 chips in it (which somehow were just chips, and had not spread to be full on cracks!) Since the owner of that car was out of the area at the time, I got a quote from Safelite for pure glass replacement (this was an older car). They quoted $408.97. The owner of the car said “thanks for getting the quote but I’ll pass” at that price. This implies that the added cost of “recalibration” together with the BS upcharge for billing to Safelite Solutions (and maybe the cost of a slightly different shape of glass for my minivan instead of this SUV?) is $472.90.

Oh I should also add here that Safelite Solutions and PBMs have another thing in common (probably a good thing?) - pretty much only covering generics. One of the first questions Safelite and other glass repair places ask is “are you ok not having OEM glass?” When I inquired about the difference, the repair technician told me that the physical difference is a nice little manufacturer logo etched onto the bottom of the glass, and the financial difference is that I’d be out another ~$400 - Safelite Solutions would NOT be paying for the little logo. PBMs generally do the same thing - you want Crestor®? That’ll be $800. You want rosuvastatin from whichever generic company the pharmacy chooses? That’ll be your $5 copay, sir.

The other similarity between PBMs/pharmacies and Safelite Solutions/glass repair that I’m fascinated by here is the specificity of the prices. In most of my life experience, prices round off to a dollar, or to 99 cents, 95 cents or maybe 50 cents. It’s pretty rare in my experience as a shopper/consumer to see prices that end in 2 cents or 7 cents or 4 cents, but all of the relevant prices I was quoted by SOS and by Safelite ended in such specific numbers of cents. Pharmacy is like this too. I regularly see reimbursements from PBMs that are $0.47 or $662.83 or $314.64. (PBMs definitely set drug prices). In pharmacy, this is because basically all of the prices are determined by some formula that often starts with a WAC set by a manufacturer that’s some more normal price like $500.00, and then through a series of markup and discount calculations by at least 4 different computers, you go from $500 WAC to $600 AWP to AWP minus 19.92% + $0.05 dispense fee = $480.53 total reimbursement times 25% coinsurance = $120.13 patient copay. I can only imagine what kind of weird pricing algorithms the various glass shops use (please comment if you know details!) to end up with similarly precise prices. Actually, it occurs to me that any time you see pricing like that, there’s probably some big price setting entity in the middle of that industry, and all of the prices are algorithmic markups/discounts against that price. Or it’s the stock market where there are a gazillion computers bidding in real time against each other. But something tells me that the $881.87 price that Safelite charged my carrier was not the result of an intensely competitive bidding war for a security with thousands of transactions per day.

That was a lot of words to explain some of the similarities between Safelite Solutions and the PBM industry. I’ve recently realized that one of my frustrations with PBMs is the lack of legibility of the system to anyone but a deep insider. Prices (both reimbursements and copays) just appear to be generated from a literal black box/random number generator. Determinations of “is this covered or not” are similarly illegible for most of the population. Yes, you might be able to find a formulary, but is it up to date? Is it YOUR formulary? Why are there 5 tiers and different copay prices at different pharmacies? Why does the pharmacy lose money on some slot machine claims and very rarely hit triple sevens on some obscure drug that the pharmacist has never heard of? What the heck is a “deductible” and a “copay” and “coinsurance” and what are these “rebates” that apparently happen? Why can’t I know the price until AFTER you bill my insurance? It was weird dealing with a similar type of illegibility with Safelite. I suspect that I’m not the only person that dislikes this illegibility. To echo Stoller’s original article, Safelite isn’t a Pharmacy Benefit Manager, but its business model sure rhymes with Pharmacy’s Biggest Mistake.

Great piece. I had to laugh at the part about Crestor. I'm supposed to have been on the generic version for the last year. Somehow CVS says my Emblem insurance doesn't cover it. Between the doctor, CVS, and an occasional letter from express scripts I've never been able to attain any. To be fair I've given up. I'm sure the doc will yell at me next checkup. God bless America.